Insurance, as we know it today, has a rich history that dates back to ancient times. The concept of mitigating risk through collective cooperation has evolved over centuries, resulting in the complex and diverse insurance policies we have today. In this blog, we will delve into the fascinating journey of insurance, exploring its origins, development, and the many ways it has adapted to meet the changing needs of society.

Ancient Beginnings: From Collective Responsibility to Formalized Pacts

The roots of insurance can be traced back to ancient civilizations such as Babylon, where traders and merchants would distribute their goods across several vessels to reduce the risk of loss due to piracy or shipwrecks. This practice effectively distributed the risk among multiple parties, laying the groundwork for the modern concept of risk pooling.

In ancient Greece and Rome, benevolent societies provided financial assistance to members in times of need, demonstrating an early form of mutual aid and solidarity. This communal approach to risk management formed the basis for future insurance principles, emphasizing the collective responsibility of members to support one another.

Medieval Guilds and Marine Insurance: The Emergence of Formalized Risk Transference

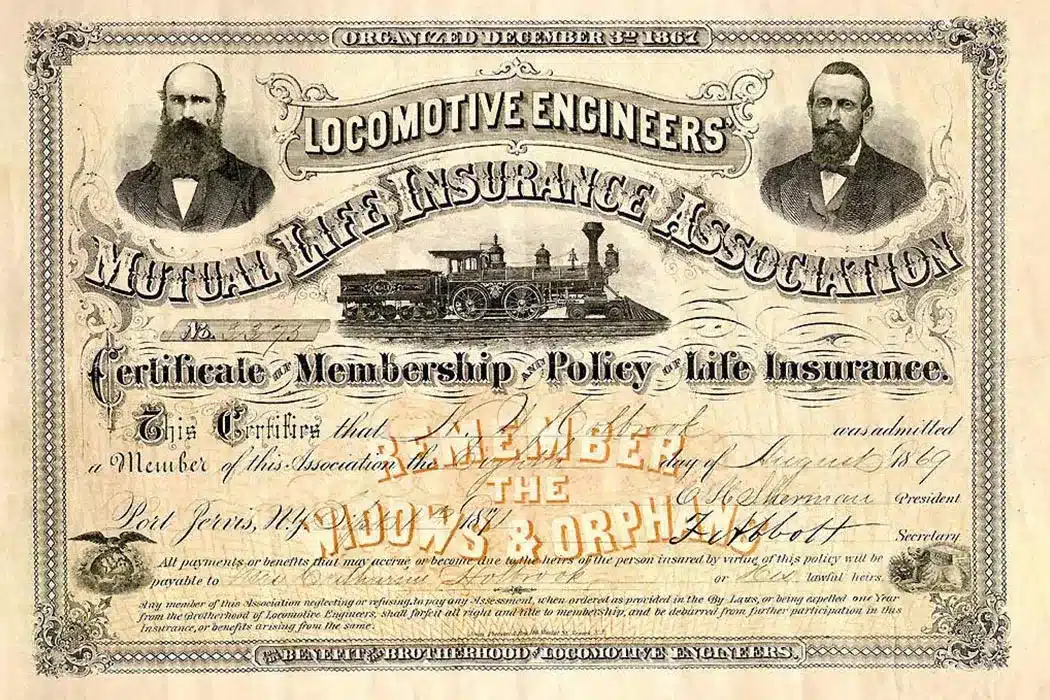

During the Middle Ages, guilds and trade associations in Europe began to offer mutual aid and protection to their members, especially in industries prone to risks such as fire, theft, and accidents. Guilds would compensate members for their losses, creating a system of shared responsibility and financial support akin to modern insurance.

The evolution of marine insurance marked a significant milestone in the development of formalized risk transference. In the late medieval period, marine insurance emerged as merchants sought protection against the perils of sea voyages. Lloyds of London, founded in the late 17th century, became a prominent hub for marine insurance, pioneering policies that provided coverage for complex maritime risks.

Modernization and Industrial Revolution: Actuarial Science and Standardized Policies

As the world entered the era of industrialization, insurance underwent significant transformation. Actuarial science, which utilizes statistical and mathematical methods to assess risk and uncertainty, became integral to the development of insurance policies. Actuaries played a crucial role in determining premiums, reserves, and policy terms, ushering in a new era of data-driven risk management.

The 19th and 20th centuries saw the standardization of insurance policies and the emergence of diverse forms of coverage, including life, health, property, and liability insurance. Concepts such as indemnity, subrogation, and utmost good faith became fundamental principles underpinning insurance contracts, shaping the legal framework of modern insurance practices.

Contemporary Landscape: Technological Advancements and Globalization

The 21st century has brought about unprecedented changes in the insurance industry, driven by rapid technological advancements and global interconnectivity. Insurtech, a term referring to the integration of technology into traditional insurance practices, has revolutionized policy administration, underwriting, and claims processing, offering enhanced efficiency and customer experience.

Furthermore, the expansion of insurance markets across borders has led to the development of multinational insurance programs and innovative risk management solutions for businesses operating on a global scale. The dynamic nature of modern risks, including cyber threats, climate change, and geopolitical instability, has necessitated the continual adaptation of insurance products to address emerging challenges.

Conclusion: Navigating the Future of Insurance

The evolution of insurance from ancient times to the present day reflects the timeless need to shield individuals and businesses from unforeseen perils. As insurance continues to evolve in response to societal, economic, and technological changes, it remains a cornerstone of financial security and risk management.

Understanding the historical trajectory of insurance provides valuable insights into the resilience and adaptability of this vital industry. From ancient maritime practices to sophisticated risk modeling, the evolution of insurance stands as a testament to human ingenuity and the enduring commitment to safeguarding against uncertainty.

In conclusion, the journey of insurance serves as a testament to the enduring value of protection and risk management in an ever-changing world. As we look to the future, the evolution of insurance will undoubtedly continue, guided by innovation, collaboration, and a steadfast commitment to serving the needs of individuals and businesses worldwide.